The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. In an effort to ease the burden of homeowners the EPF introduced the Housing Loan Monthly Instalment Withdrawal.

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Passport Certification of Citizenship other identification documents for former Malaysian Citizens that were EPF members before 1 August 1995 who are unable to produce an identification card Birth CertificateIdentity Verification Letter by the National Registration Department - if the date of birth stated on your identification card.

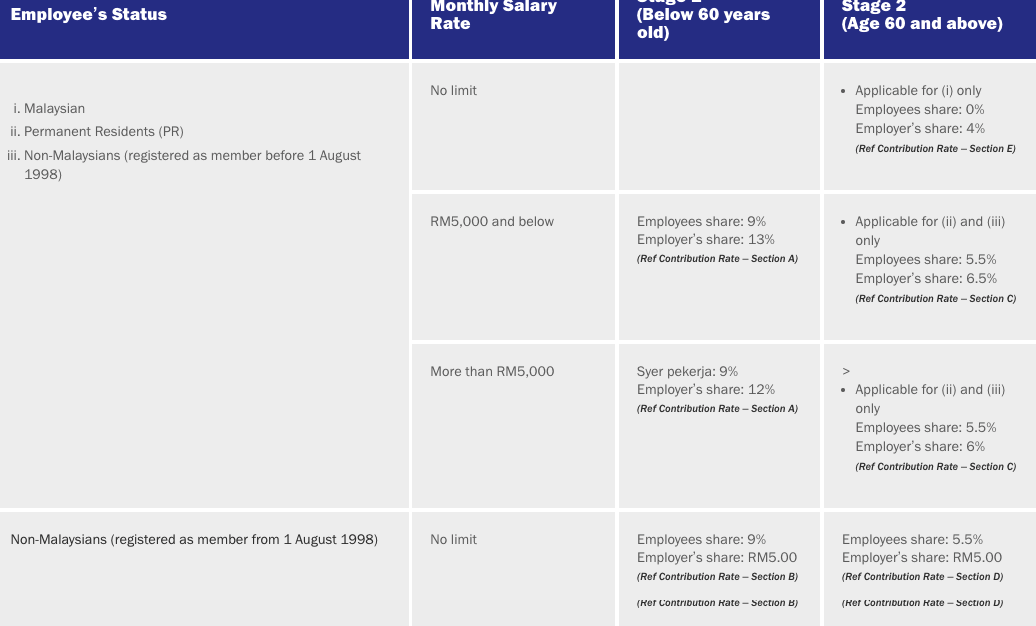

. Based on the Contribution Rate within the Third Schedule the employers contribution should be RM756 12 while the employees contribution stands at RM567 9. Salary for January 2018 Therefore the Contribution Month is February 2018 and it has to be paid either before or on 15 February 2018. In this Part referred to as the EPF Board being a body corporate established under the repealed Act shall likewise.

The amount limit is a minimum of RM10 and up to a maximum of RM60000 per year. Widowwidower child or members parents subject to members marital status. Government contribution is limited to members who are below age 60.

You can make a tax deduction from your aggregate income if you. As an employer you are obligated to fulfil specific responsibilities including to register your organisation and employees with the EPF ensure orderly contributions and record keeping as well as comply with the existing policies and requirements. The employer needs to pay both the employees and the employers share to the EPF.

For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers. Transfers from employment in Malaysia under an employer by whom an approved fund has been established to employment outside Malaysia under the same employer. If you are an individual earning more than RM34000 per annum which roughly translates to RM283333 per month after EPF deductions you have to register a tax file.

Employee As monthly remuneration including all liable payments as mentioned above stands at RM6250. Copy of old passport used when EPF account was registered. Salary for January 2018 Therefore the Contribution Month is February 2018 and it has to be paid either before or on 15 February 2018.

Employer must make monthly payment on or before 15th of the month. An individual is considered a Senior Citizen if an individual crosses the age of 60 years during the financial year. Not applicable to members that receive a fixed employer contribution.

The Death Benefit is a gesture of compassion by the EPF to our members next-of-kin under EPFs discretion. So that when you find yourself in a tight spot financially you can make a withdrawal from your Account 2 to help cover your monthly housing loan instalment for a minimum period of six months or until your financial recovery. RM 4500 x 13 refer Third Schedule EPF Employee Contribution.

Ownership of Transfer Form KTN 14A in the name of the new owner completed by the Land Office or at least a completed and signed Ownership of Transfer Form KTN 14A with the submission receipt by the Land Office. Any proof of relationship must be submitted with transfer of house ownership based on love. The CPF is an employment-based savings scheme with the help.

There will be a difference between the amount in Third Schedule and the actual calculation by percentage. The Central Provident Fund Board CPFB commonly known as the CPF Board or simply the Central Provident Fund CPF is a compulsory comprehensive savings and pension plan for working Singaporeans and permanent residents primarily to fund their retirement healthcare and housing needs in Singapore. A one-time payment of RM2500 will be considered and awarded to any of the deceased members eligible dependents.

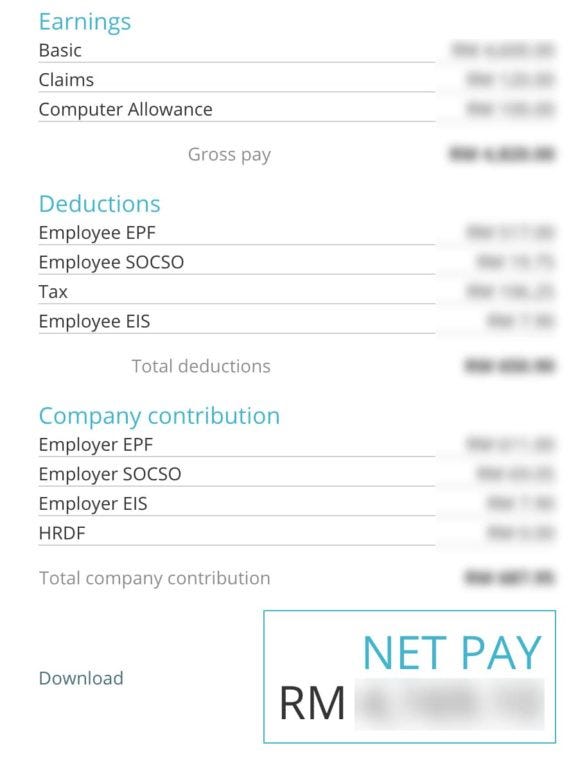

Please quote your EPF member number or identification number NRICpassport and the subject of your query when contacting the EPF. For employees working in Malaysia registered entities be it local or foreigner work pass holders it is a norm to see in their monthly pay slip indications of monthly contribution deducted from their monthly salary as well as their employersThis article will explain in detail what these monthly deductions entails to and why they are required by the Employment Act 1955. RM 4500x 11 refer Third Schedule.

07 OCT INFO EPF RECORDS RM27 BILLION GROSS INVESTMENT INCOME FOR 1H 2022. Gain peace of mind as our EPF table PCB calculation and EPF contribution rates are updated and accurate as of EPF 2021. In Malaysia the EPF also common known as KWSP or Kumpulan Wang Simpanan Pekerja is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 which provides retirement benefits for member through the mandatory contribution from two parties.

Calculate your salary EPF PCB and other income tax amounts online with this free calculator. Not applicable to members that receive a fixed employer contribution. Proof of SaleDisposal of first house.

Employer must make monthly payment on or before 15th of the month. The step by step guide you need when it comes to filing your personal income taxes in Malaysia for YA2020. Join i-Suri now to earn annual EPF dividend.

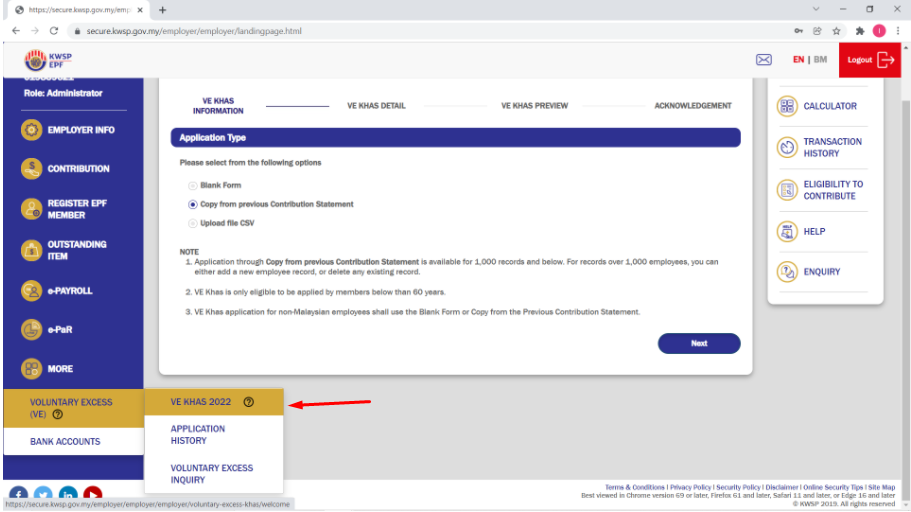

EPF Employer Contribution. Im An Employer i-Akaun LOGIN. The Employees Provident Fund EPF supports the Governments measures tabled in Budget 2022 which are conducive towards fostering economic recovery improving livelihoods as well as spurring employment which can pave the way for Malaysians to rebuild their retirement fund.

The monthly wages of Malaysians aged 60 and over and non-Malaysians of any age do not affect the employers EPF contribution rate. RM60000 yearly for all Voluntary Contribution Self. If members particulars are incomplete or mismatched in EPF records Letter Confirming the Identification of Applicant from employer OR.

Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior citizens. Scam Alert Keep abreast of the latest scams. Housewives can now opt for the new i-Suri incentive receive government contribution up to RM480 per year.

If original passport is not with the applicant Temporary travel permit from the Embassy of applicants country in Malaysia. KUALA LUMPUR 29 October 2021. A portion of an employees salary and.

Government contribution is limited to members who are below age 60. During the tabling of the Budget 2022. For Malaysia Residents Non-Residents Returning Expert.

Kasih Suri Keluarga Malaysia KWSP Top-up Savings Contribution effective January 2013. The amount limit is a minimum of RM10 and up to a maximum of RM60000 per year. The rate of contribution in the third schedule is set based on range between wages amount.

This brings the total monthly EPF contribution to RM1323. Employers contribution irrecoverable from employee. Given below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime.

The employer needs to pay both the employees and the employers share to the EPF. Kasih Suri Keluarga Malaysia KWSP Top-up Savings Contribution effective January 2013. Gain peace of mind as our PCB calculation and EPF contribution rates are updated and accurate as of 2022.

Housewives can now opt in for the EPF contributions via our new special incentive under Kasih Suri Keluarga Malaysia KWSP.

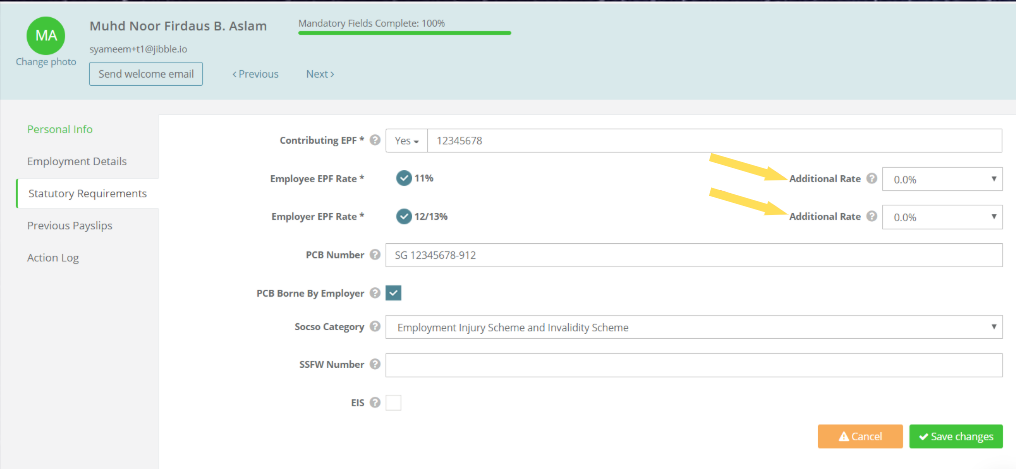

Payroll Panda Sdn Bhd How To Increase Epf Contributions For An Employee And Employer

Understanding Your Malaysian Payslip Benefits Deductions By Helmi Medium

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Epf Contribution At 11 Causes Confusion For Employers Here S A Quick Guide

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Steps To Maintain Current Employee Statutory Contribution Rate Asq

Just An Ordinary Girl Singapore Cpf Vs Malaysia Epf

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Planit Employer Epf Contributions Case Study Planipedia

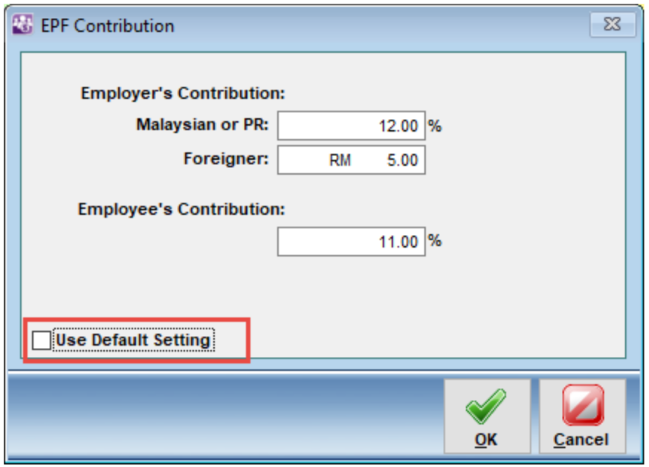

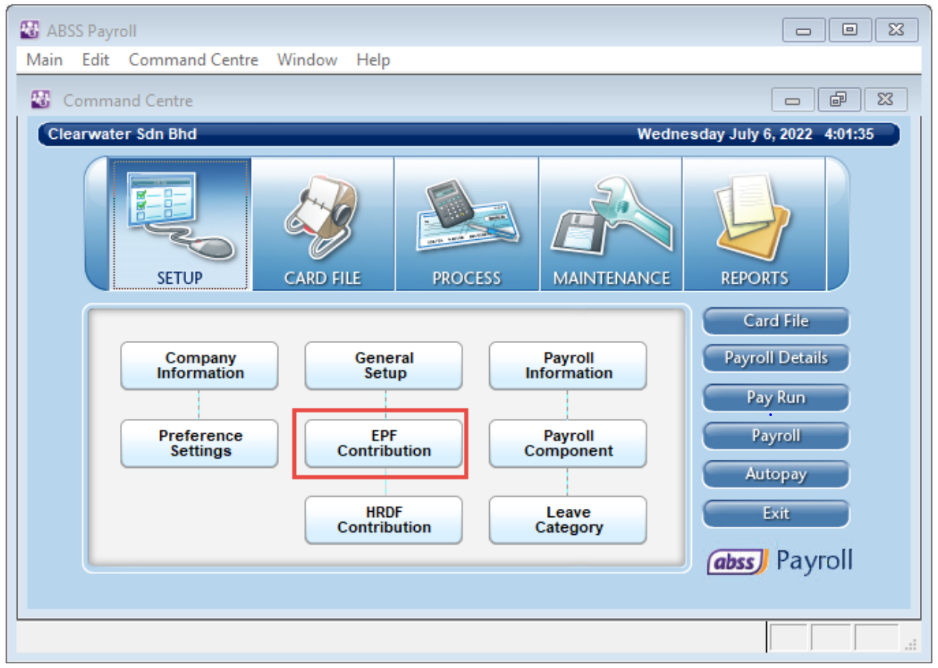

How To Update Epf Rate In Abss Payroll Abss Support

How To Update Epf Rate In Abss Payroll Abss Support

Best Payroll Sotware Malaysia What Is Subject To Epf Sql Payroll Hq

Epf Labour Law Topic 9 Employees Provident Fund Act Epf The Main Objective Of The Employees Studocu

Planit Employer Epf Contributions Case Study Planipedia

Summary Of Case Study On Employee Provident Fund Of Malaysia